Equity Swap Insights

Your Institutional Edge

Equity swaps are the leveraged engine of the market. See where institutions place their largest bets and when they have to move.

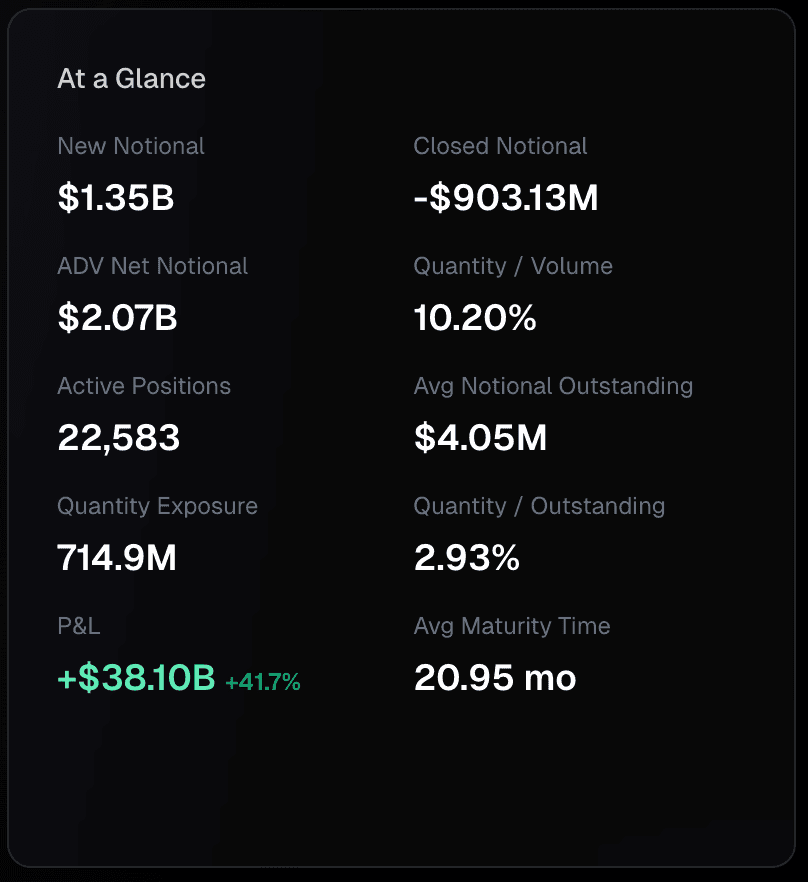

Proprietary Data at Scale

The only platform providing institutional-grade equity swap intelligence. Track billions in leveraged exposure across thousands of securities.

Built for Modern Traders

VantaPool analyzes the swap market to give you an institutional edge. Monitor hidden leverage, manage trade risk, and spot the next major market catalyst before it happens.

Track Institutional Positioning

Monitor where the smart money is accumulating positions

Detailed Stock Analysis

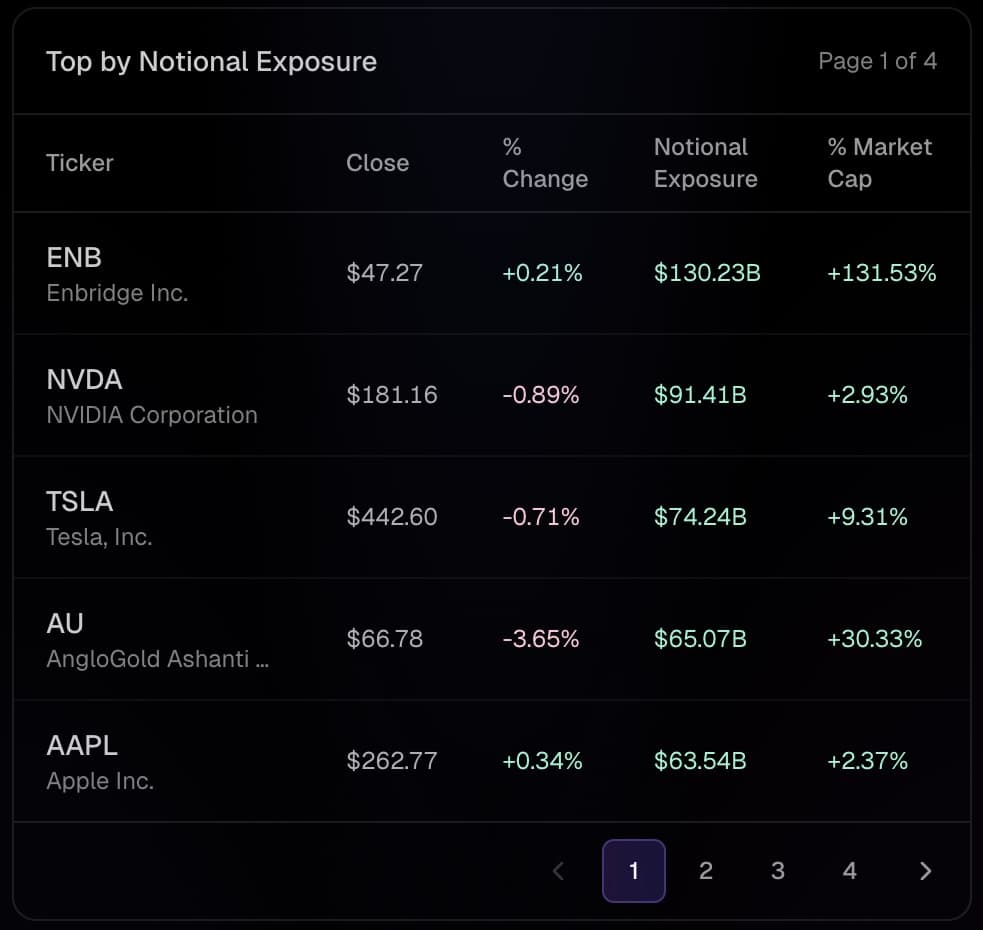

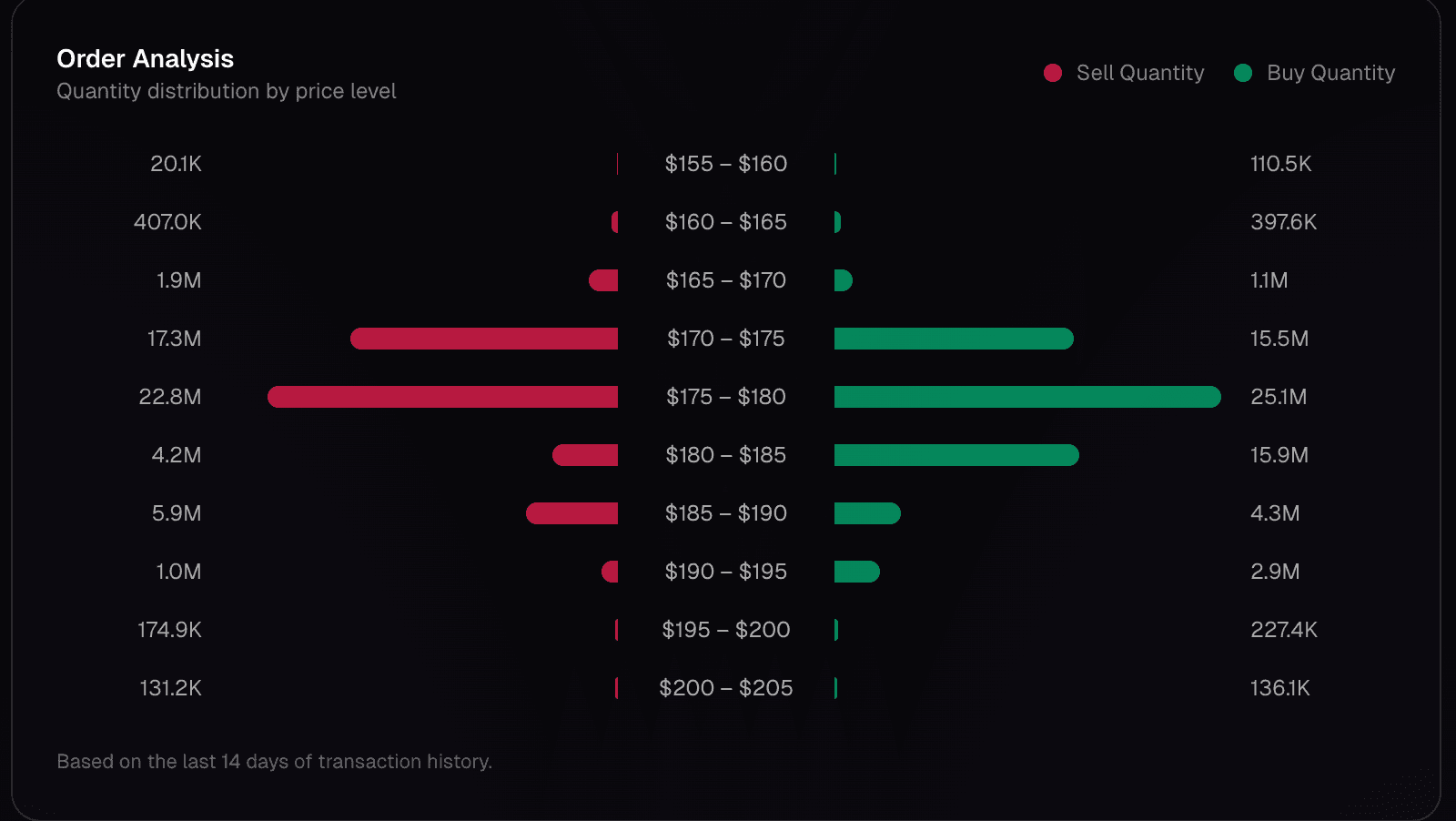

Deep dive into individual stocks with comprehensive institutional positioning data

Spot Emerging Trends

Identify institutional money flows before they impact price

Deep Dive Into Any Stock

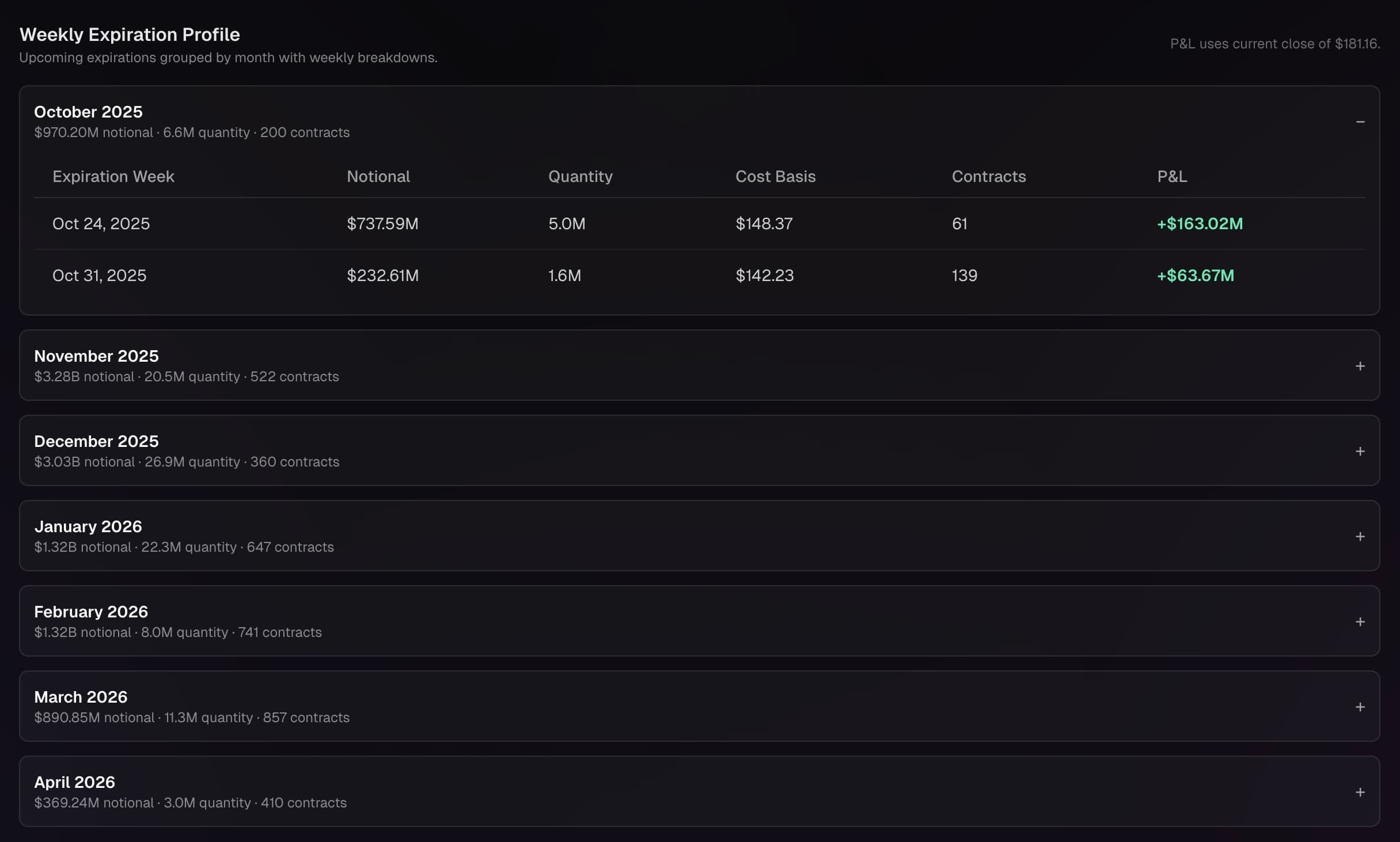

Comprehensive institutional positioning data for every security. Track swap activity, historical trends, and upcoming expirations all in one place.

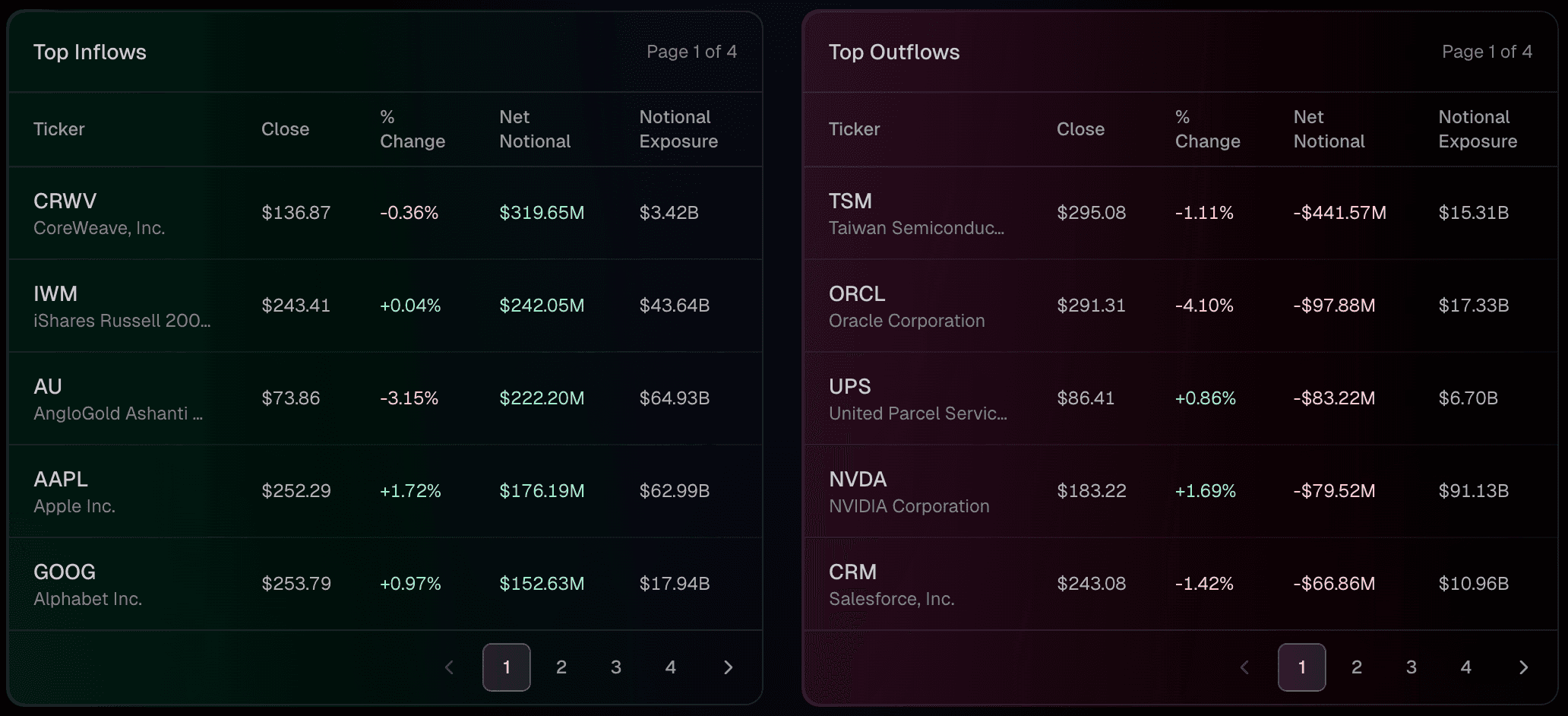

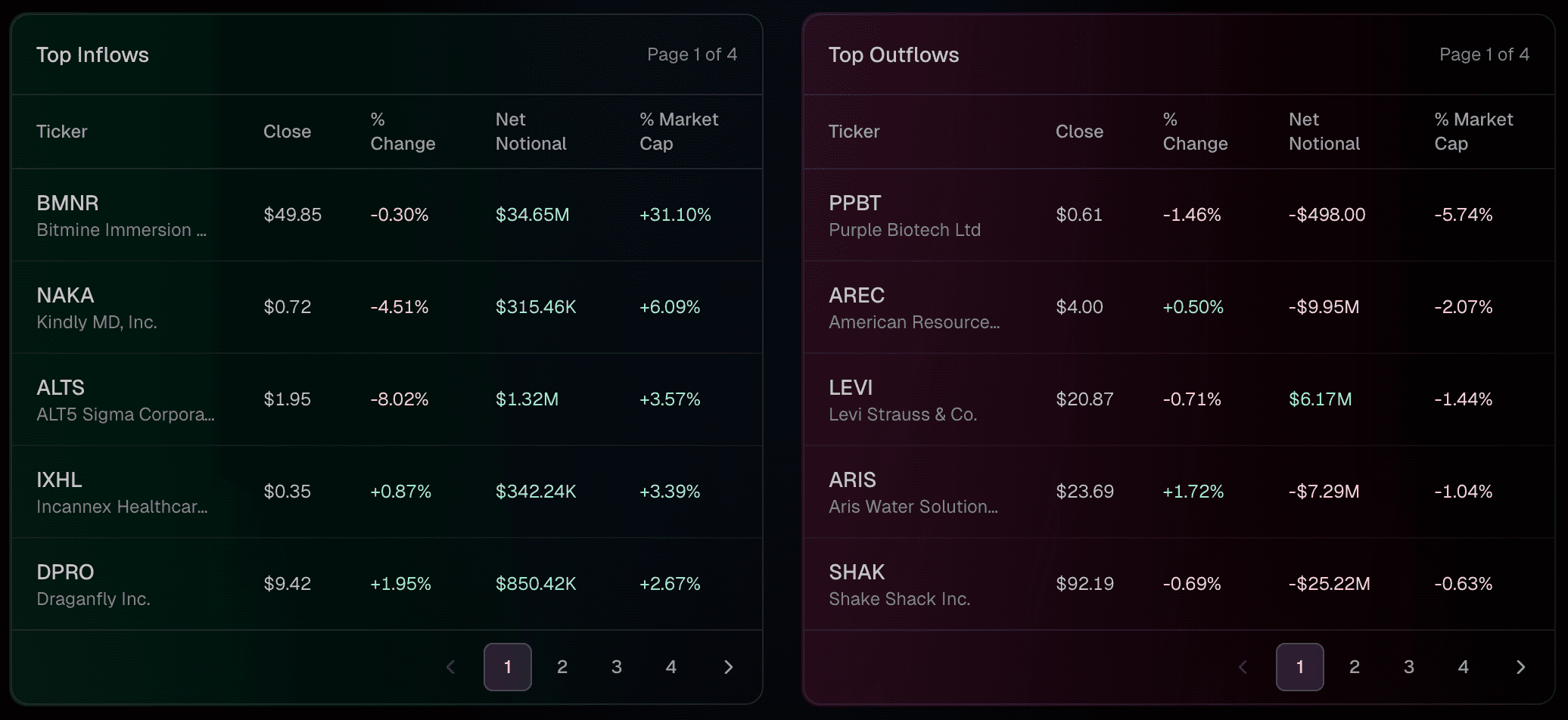

Recent Activity

Monitor the latest institutional trades and position changes. See what the smart money is doing right now.

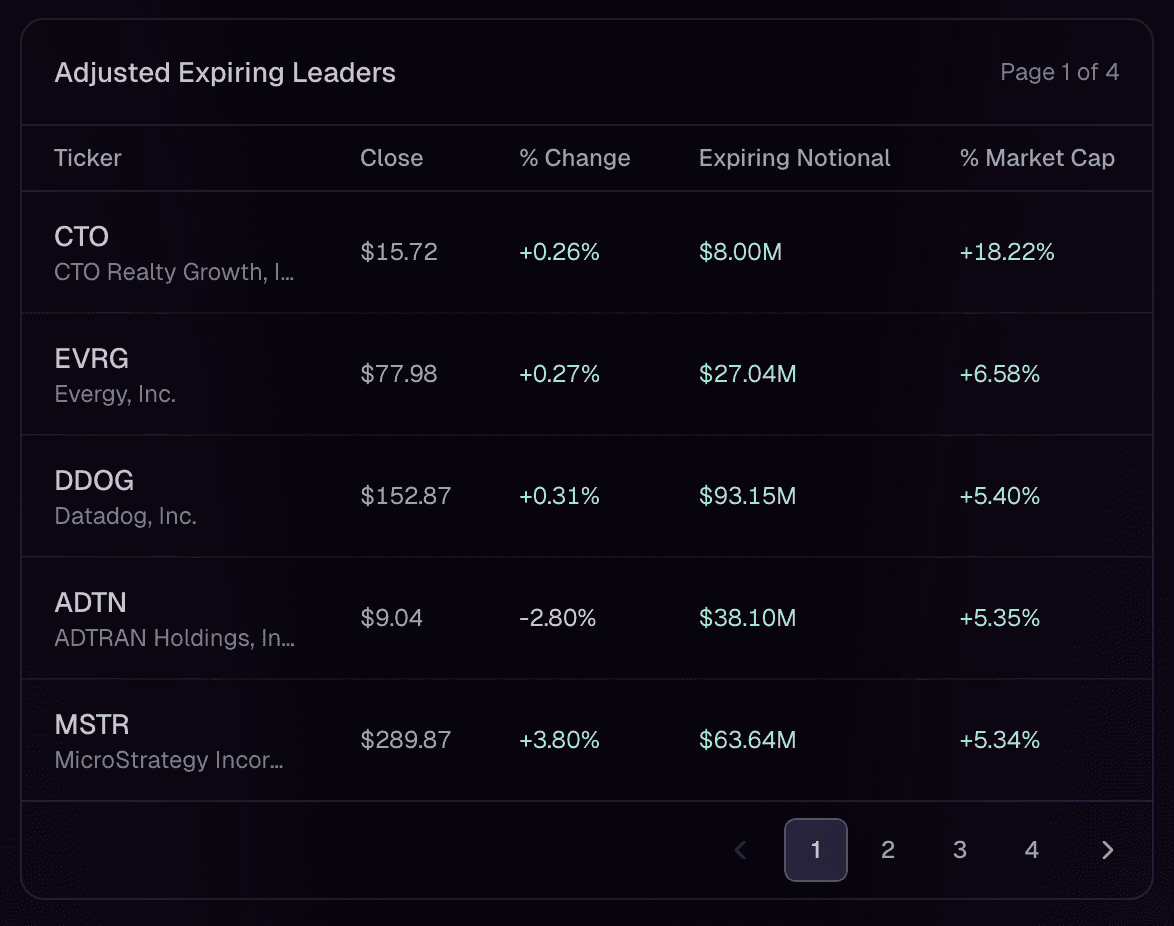

Expiration Timeline

Track upcoming swap expirations and forced buy/sell events. Anticipate market-moving catalysts before they happen.

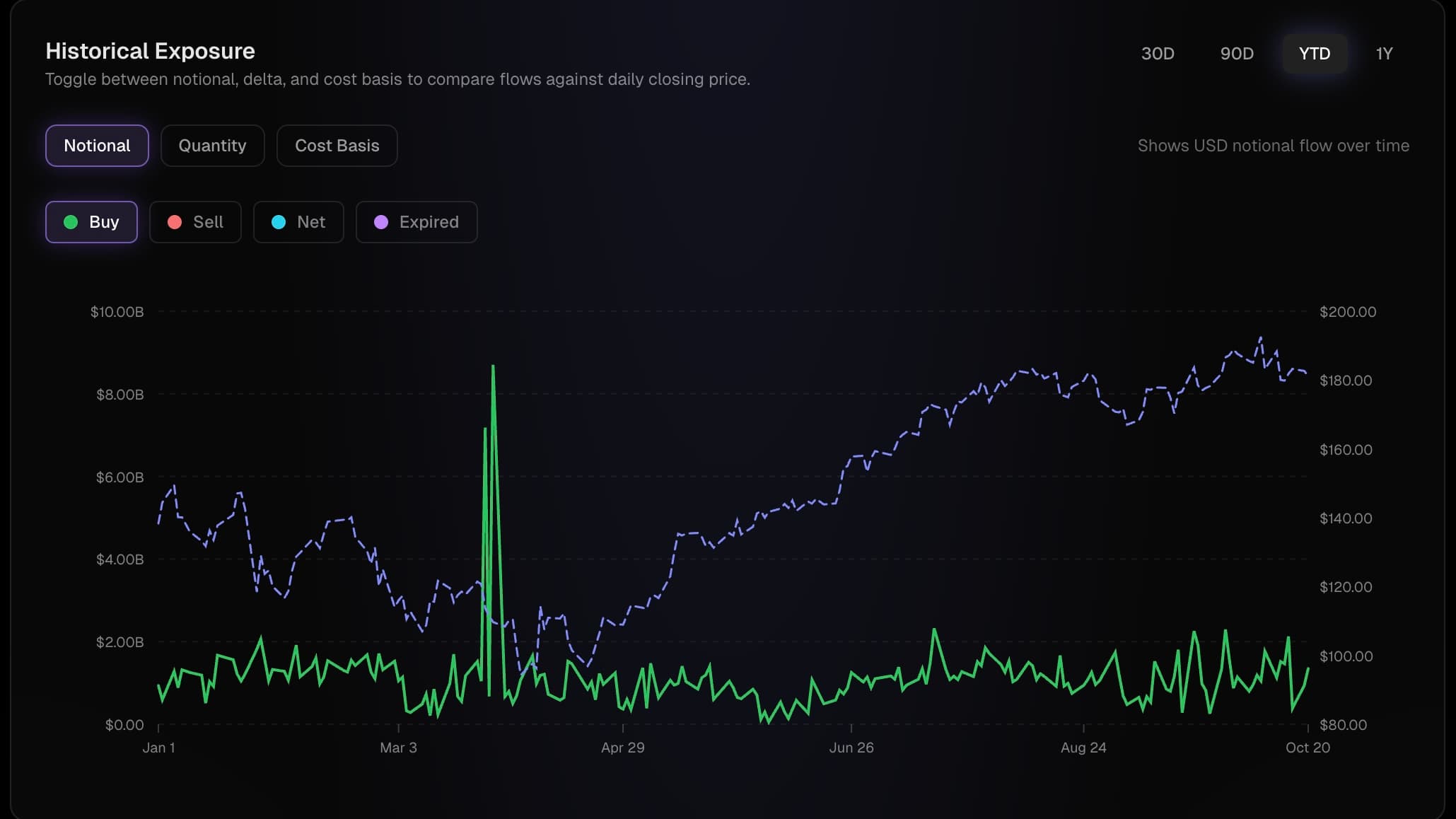

Historical Analysis

Analyze years of institutional positioning data. Identify patterns, correlations, and trends that inform better trading decisions. See how positioning changes correlated with price movements over time.

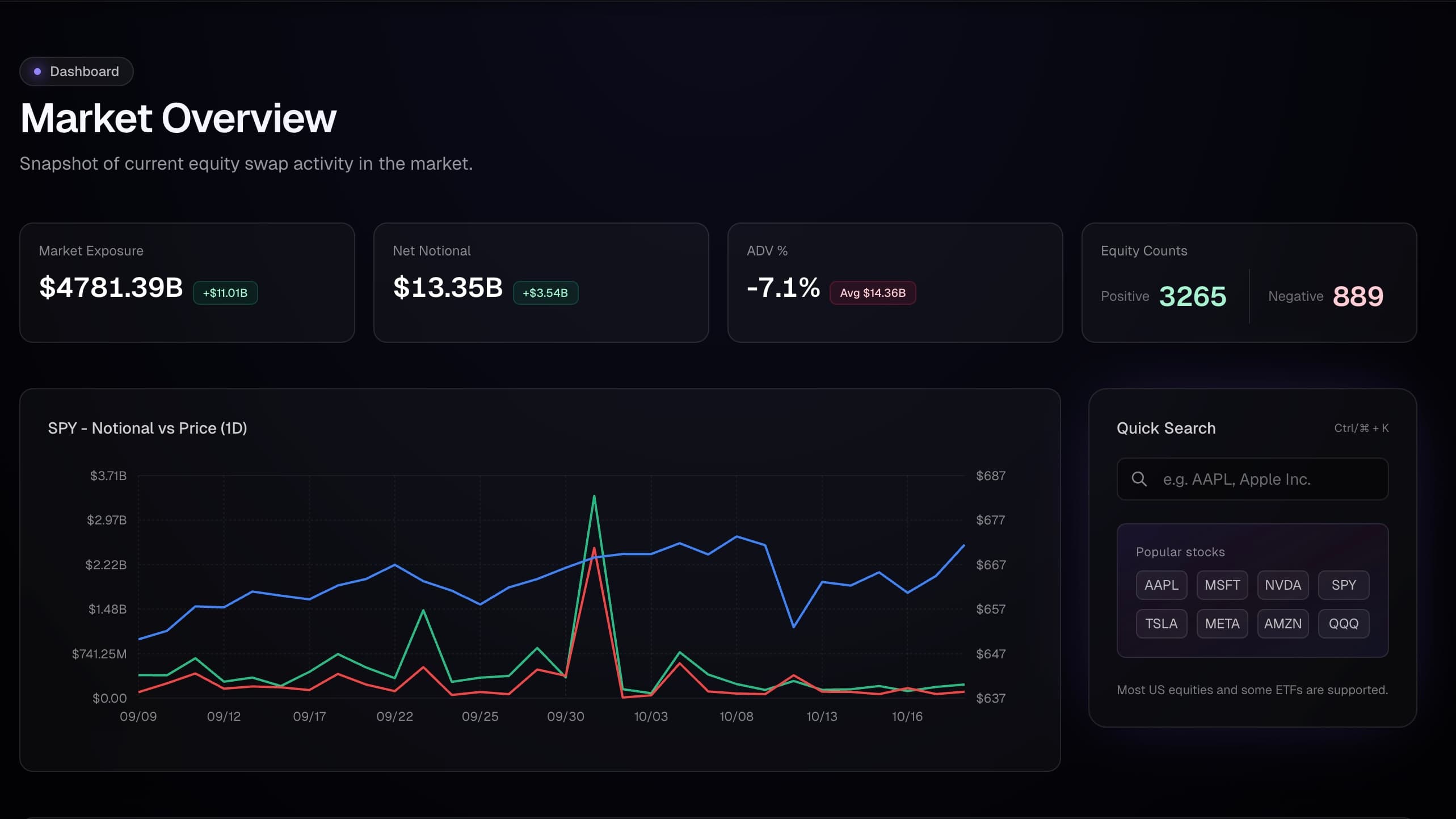

Track Institutional Activity

Monitor equity swap flows across the entire market. See where institutional capital moves before it impacts price action.

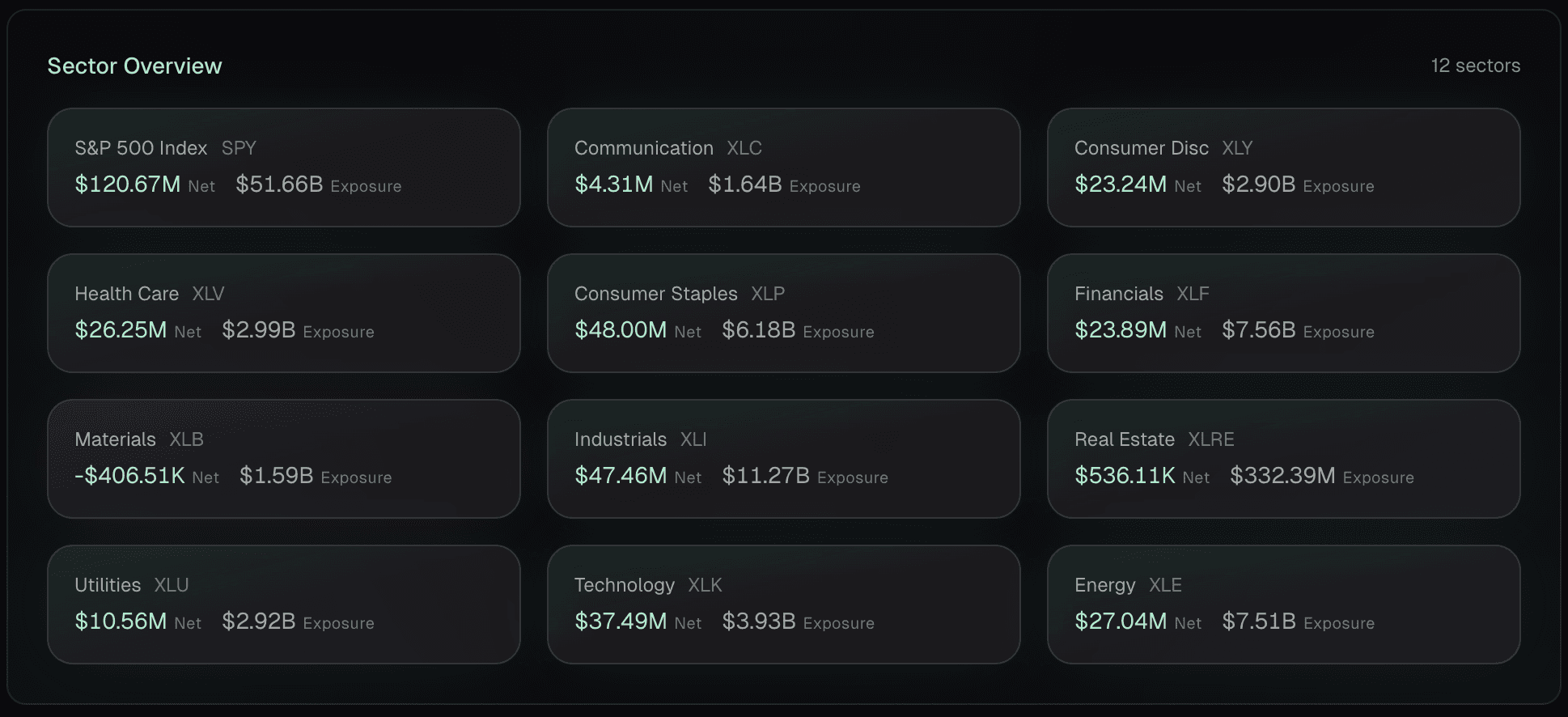

Sector Intelligence

Track institutional flows by sector and industry. Identify rotation patterns before they become obvious.

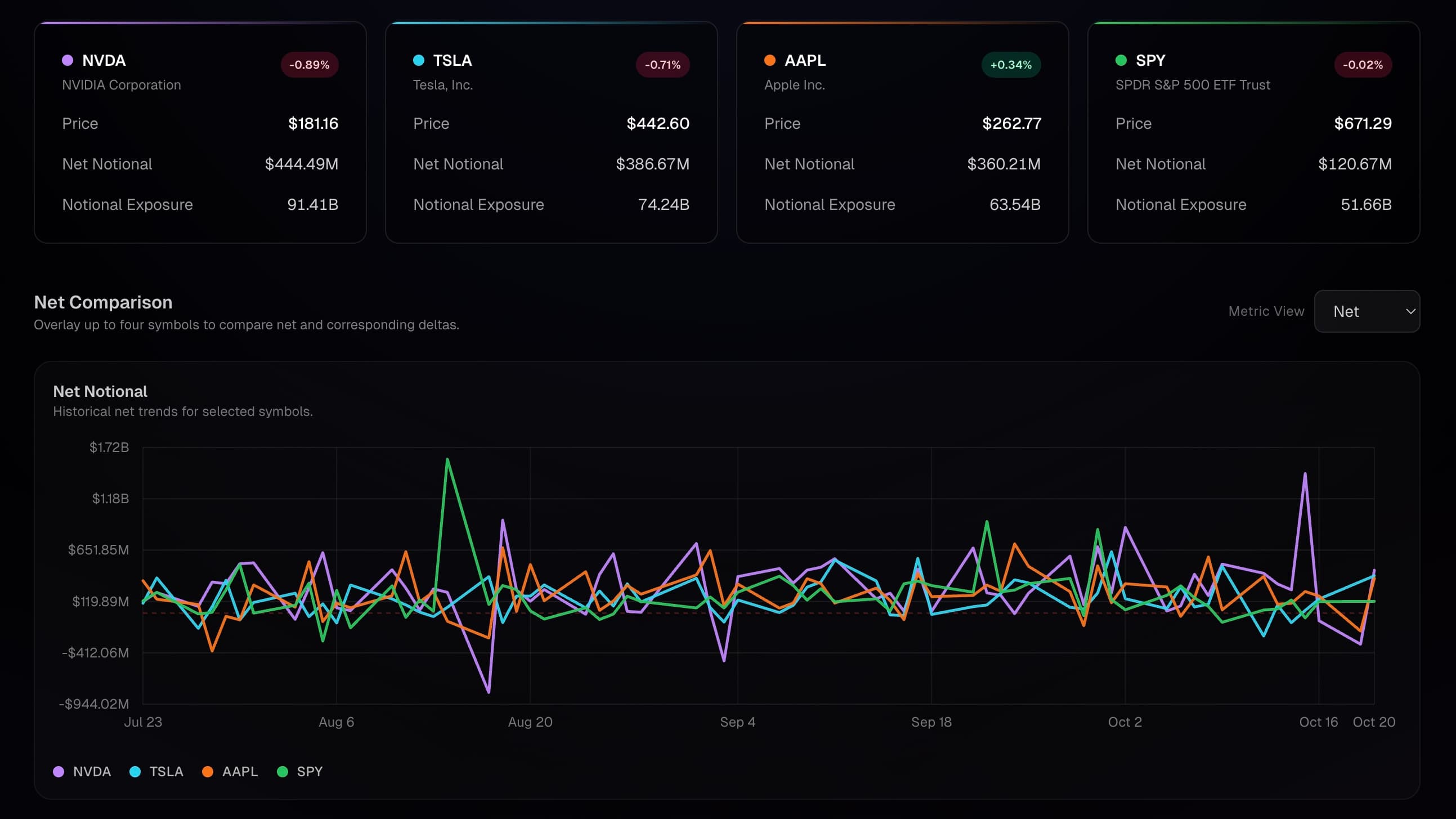

Side-by-Side Comparison

Compare swap activity across multiple tickers. Analyze relative positioning and flow divergences.

Market Leaders & Movers

See the top institutional positions across different metrics. Filter by notional exposure, adjusted holdings, or expiration timelines.

The Market's Best Kept Secret.Until Now.

Join the traders who know what's happening before everyone else. Because at this level, only the best data wins.

Subscribe to unlock institutional-grade equity swap intelligence.